AUDIT APPROACH

Auditing as chance for growth.

Our type of approach

1

Each of our assignments is carried out in compliance with the highest quality standards, through advanced methods and in full compliance with the agreed deadlines.

2

Our philosophy is based on three fundamental aspects:

- The Customer at the centre of the Project.

- Needs, Requests and Deadlines are priorities.

- The Audit firm as an assistant and not just a mere legal obligation.

3

The work approach is “customised” and “personalised” for each different type of assignment, based on the potential risks identified (Audit Risk Approach).

4

Professional Audit Group S.r.l. Offers quality service based on the direct involvement of Managers and Partners in the activities, the continuous feedback with the customer, the ethics, the expertise and the passion of each professional. Independence, integrity and confidentiality towards the customer is a source of special attention on our part.

5

Compliance with the principles of law and auditing and continuous training guarantee quality services.

The professionals are experts and technicians but, above all, they are people.

The members of our Teams will follow you with dedication from day one, understanding your needs, scheduling work according to your deadlines but, above all, they will create a relationship of trust that has always been the added value that Professional Audit Group boasts towards its customers.

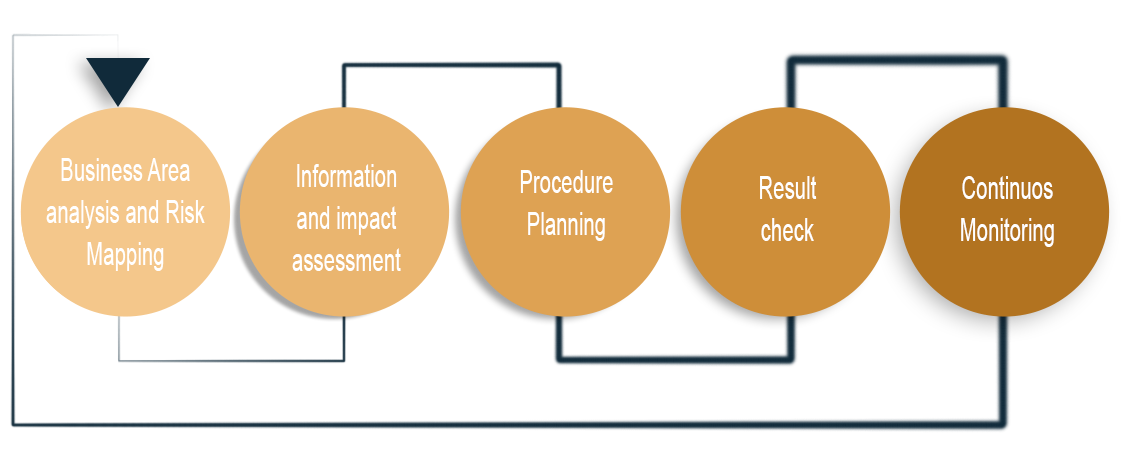

Analyses

Planning

Assessment

Checks

Result check: analysis of the results obtained and the effectiveness of the adopted procedures;